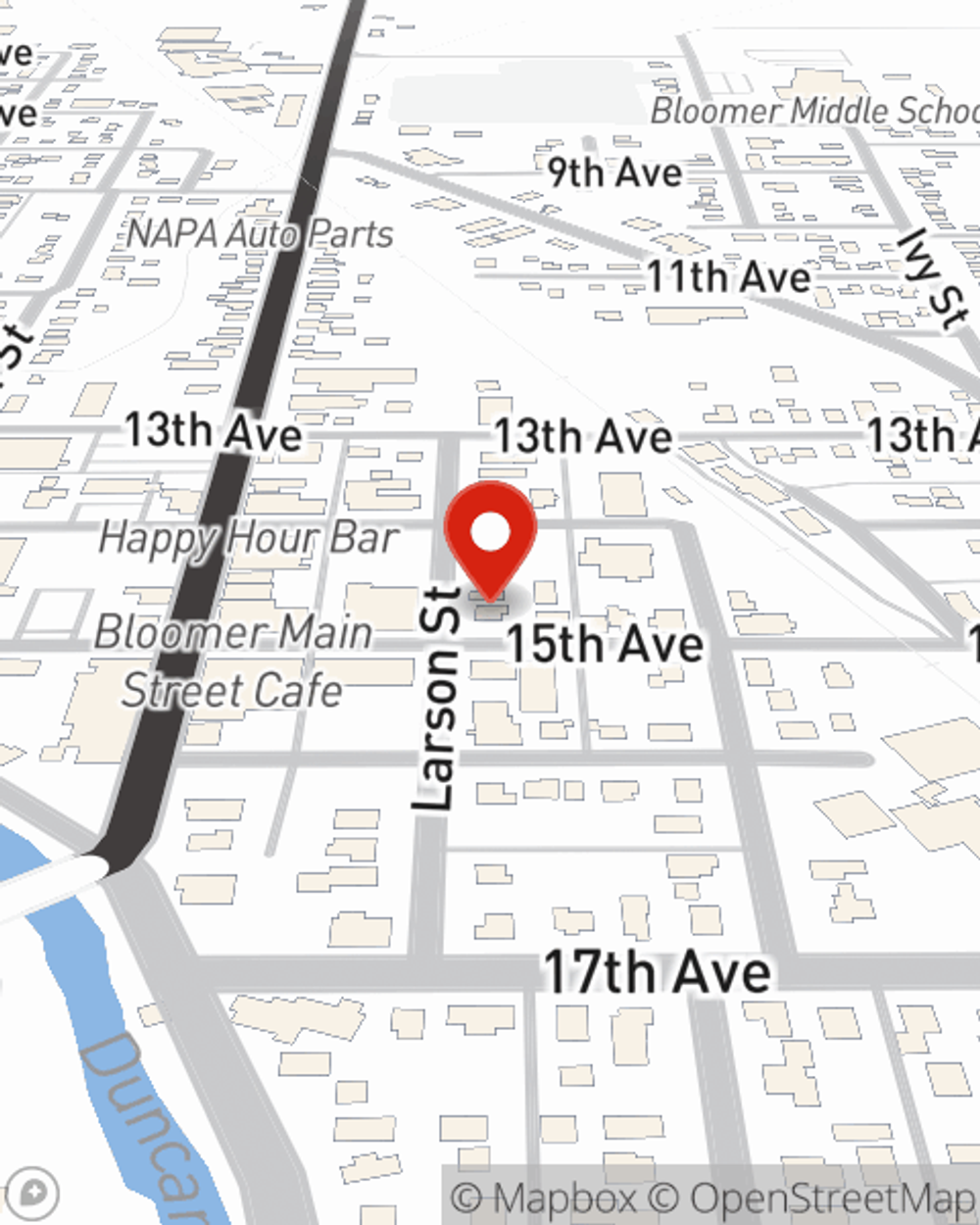

Business Insurance in and around Bloomer

One of the top small business insurance companies in Bloomer, and beyond.

Insure your business, intentionally

State Farm Understands Small Businesses.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected problem or damage. And you also want to care for any staff and customers who stumble and fall on your property.

One of the top small business insurance companies in Bloomer, and beyond.

Insure your business, intentionally

Protect Your Future With State Farm

Being a business owner requires plenty of planning. Since even your most detailed plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like worker's compensation for your employees and extra liability. Terrific coverage like this is why Bloomer business owners choose State Farm insurance. State Farm agent Tim Reedy can help design a policy for the level of coverage you have in mind. If troubles find you, Tim Reedy can be there to help you file your claim and help your business life go right again.

Take the next step of preparation and contact State Farm agent Tim Reedy's team. They're happy to help you learn more about the options that may be right for you and your small business!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Tim Reedy

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.